Track Group, Inc (TRCK): a Double-Digit Recurring Revenue Growth Story Trading at 6x EBITDA

Track Group is a long-term secular growth story with two imminent hidden catalysts that will uplift the stock

Preface

An underappreciated advantage retail investors have is the ability to enter most stocks without swinging their share price. This allows them to spend time on the best stories and buy them before their volume expands. XPEL, one of the most beloved stocks in the micro-cap community traded an average of US$12,112/day, before volume rapidly expanded in 2017/2018. In the case of Track Group, I believe it to be a unique opportunity for investors with small net worth to enter a gem before it is discovered by the market.

Quick Summary

Following years of business underperformance, Track Group has been left for dead by investors despite consistent revenue growth and profitability improvement over the past 6 years. Now, the stock trades at laughable multiples (around 6x EBITDA) but operates profitably in a secularly growing industry, with a significant technological MOAT, a new large contract award, and a balance sheet that looks much cleaner.

Company Description/Business Model

Track Group was founded in 1997 and used to operate under the name SecureAlert, a subsidiary of RemoteMdx, which provided medical alert devices. The company leveraged its medical expertise to develop remote monitoring devices for the criminal justice systems.

Their business model is simple; the company enters into long-term contracts with various governmental agencies, selling and leasing ankle & curfew monitoring devices. Once the sale or leasing is contracted, TRCK continuously provides governmental agencies access to their analytics & tracking software, and their monitoring centers, which provide 24/7 support for all devices (continuous alert monitoring, offender communication, technical support, etc). Through these services, the company generates subscription-like revenues based on the number of installed devices. For the fiscal year ended September 2020, TRCK generated over 98% of its sales from Monitoring and Other Related Services. Thus, the company operates a highly recurring business model that has room to scale.

MOAT/Competitive Edge

Track Group's product offerings are highly sophisticated thanks to years of research & development, which serves as its competitive MOAT. Its products are patented and the company spends between $1-2M in R&D every year. Its flagship product, the ReliAlert™XC 4, is the only 3-way voice communication device operating on the LTE network (They can communicate with the offender and authorities in real-time). Once an agency chooses a monitoring device company, they must train their employees to properly use TRCK’s software. In addition, if an agency rescinds a contract, they must either replace all the devices or continue using both their new contractor and old contractor simultaneously. These two factors make switching costs high. Through the acquisition of G2 research, the company expanded its MOAT and amassed a wealth of proprietary data from other monitoring devices which allows them to better predict offender behavior. Offender behavior data has helped them launch new software targeted for the victims of offenders, allowing victims to be alerted of any possible danger. Finally, they have launched a device-agnostic network platform that runs on any device, allowing them to partner with agencies to run analytics and collect data from their competitor's devices.

Quick Industry Trends/Competitors

Before COVID, the electronic offender-tracking device market was expanding rapidly. According to an article by the PEW Charitable Trusts (link below), the number of monitoring devices grew by 140% from 2005 to 2015. TRCK also states that in 2007, there were around 54,000 devices in circulation and that has grown to 300,000 in 2016, or 450%. While the numbers differ vastly, one thing is certain: the market is growing rapidly and TRCK is poised to capture this growth. Why is that? Many states and counties in the United States are looking at alternatives to reduce costly incarcerations. Monitoring devices, although controversial, have been shown to reduce recidivism. When COVID hit, monitoring device contract awards were halted by many counties and states agencies. However, these same agencies quickly realized the benefit of ankle monitors: they could allow home confinement for inmates who were at risk of catching COVID. Ankle monitors in circulation exploded all over the globe, and we are now seeing the effect on TRCK’s P&L.

Large competitors include BI Inc, Sierra Wireless (public company), and Attenti Group (I will use BI inc & Attenti for valuation purposes). BI inc is by far the largest device monitoring company in the United States. However, BI will most certainly lose its competitive edge through a cutback in spending given that its parent company, GEO Group (public company), has unsustainable levels of debt and is going through major structural problems as they operate for-profit prisons.

I have also found two other, micro-cap ankle monitoring companies: Jemtec Inc (<$5M market cap) and Supercom, through its LCA Services subsidiary. Track Group seems in the top-tier in terms of product offering and technological solutions.

Background on the Stock

So what happened exactly to the stock? Before 2014, the company had high customer concentration, a poor track record of contract retention/renewal, and a business model that relied heavily on sales of devices. TRCK was unprofitable and no investors wanted the exposure to a lumpy business. To fix those issues, the board of directors hired current Chairman Guy Dubois, in hope of changing the company's lackluster performance. Mr. Dubois initiated various operating efficiency measures, redirected cash flow to R&D & CAPEX, and made a series of acquisitions to better position Track Group for the long term. However, these initiatives hurt short-term profitability and deteriorated the company's balance sheet, leading to a free-fall in the stock price.

Fast-forward to today, Mr. Dubois has assembled a management team of veterans. Derek Cassel, the current CEO, has over 20 years of experience in the criminal justice industry and made his way up the company following the acquisition by TRCK of his former employer, Emerge Monitoring, in 2014. Mark Wojcik, current CTO, has over 15 years of experience developing alcohol monitoring devices and worked as a CTO consultant for various early-stage and mid-cap companies. Finally, Matt Swando, VP of Global sales, worked for BI Inc. & Numerex, two device monitoring companies, and acted as a consultant for GEO Group. Following Mr. Dubois' appointment, TRCK achieved a revenue CAGR of 10.3% from 2015-2020. 2021 looks even better:

In Q1 2021, revenue grew by 12% and EBITDA by 50%

In Q2 2021, revenue grew by 21% and EBITDA by 77%

EBITDA margins went from negative a few years ago to 29% of revenue as of fiscal Q2 2021. The company's recurring revenues now make up the majority of its sales and TRCK continues to win contracts.

That being said, all of the above is in the past, you must be telling yourself; "Why should we be excited about the stock now, stocks are forward-looking, right?". Before I get into the catalysts, let me give you a picture of the capital structure. Fully diluted share count stands at 12.06M, the stock price is US$2.60, debt is at $44.3M, and cash at $6.7M. Thus the company has a market cap of $31.4M and an enterprise value of 69M. My first instinct was to shy away from the company due to its debt, but I believe there lies a catalyst.

Catalysts

Before Q1 2021, the company's credit facility, which consisted of $12.5M in accrued interest and $30M in principal, bore an interest rate of 8% (on the principal only). In March 2021, the company amended its debt through the same lender, reducing the interest rates from 8% to 4% (for the full $42.5M). That's almost $700K in interest savings per year. The company will be in a better position to reduce its debt moving forward.

The second catalyst is the award of a new contract that has yet to fully hit the P&L. On May 7, 2020, the Chilean Prison System awarded a new contract to a competitor, who subsequently did not sign the contract in due time. The Chilean Prison System rescinded the contract and transferred it to Track Group, effective October 1, 2020. I believe this contract to be massive. TRCK's capital expenditure expanded from $0.75M for the first half of 2020 to $1.7M for the first half of 2021. The company disclosed in their filings that the quarterly increase in their debt level was to finance two monitoring centers in Chile. I expect the contract to start ramping up in the second half of the year and will become a meaningful contributor to earnings in future years.

Why does this opportunity exist?

Despite their outstanding financial results demonstrated in the last few quarters, a growing industry, and two clear catalysts to lift the stock, TRCK continues to trade at laughable multiples. Using their run-rate EBITDA from last quarter ($2.9M/quarter), the company is trading at 6x EBITDA. Net Debt/EBITDA is approximately 3.2x, and while high, not unmanageable.

Why does this opportunity exist? The company does not seem to have a solid IR department. They do not host earnings calls and their press releases are primarily earnings-related, with little details in the releases themselves. For example, both catalysts I mentioned above could only be found if one reads the recent 10-Qs/Ks, which I believe many investors do not bother going through. The stock is illiquid (I mean really illiquid, often trades less than $5000/day) and the float is small (Around 4M shares). Lastly, it trades over the counter and that usually reduces the number of investors that can get into the stock.

Valuation

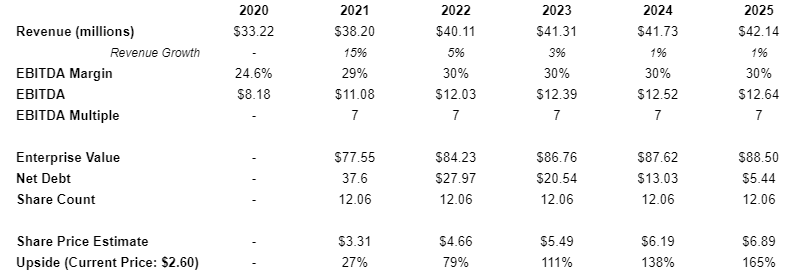

Running a very quick multiple model shows significant upside. I decelerated their growth starting in 2022 and kept margins at 30% (note that they have already achieved a 29% margin in Q2 2021). I believe the company has significant levers to improve both its revenue growth and EBITDA margin as SG&A still represents 30% of revenue. I assumed 60% of EBITDA would be converted to cash starting in 2022.

Attenti (the private company I mentioned earlier) was public up until its purchase by private equity in 2008 for 6.5x EBITDA and 1.3x revenue. Attenti’s EBITDA margin stood at 20% of revenue. In 2010, 3M bought Attenti for US$230M, estimating it would generate US$100M in revenue or 2.3x revenue. 3M sold Attenti in 2017 for US$200M. The company generated approximately $95M in sales or 2.2x revenue.

BI Inc, GEO Group’s subsidiary was purchased in February 2010 for US$415M. At the time of the acquisition, the company generated $115M in revenue, implying a 3.6x revenue purchase price.

While the stock deserves a discount to its multiple given its illiquidity and relatively smaller size, it still trades at a cheap absolute multiple and relative to other government security contractors (Most of them trade at or above 12x EBITDA). Nevertheless, I used a 7x multiple for my analysis, similar to Attenti in 2008 but slightly higher given its superior margin profile, and still got a stock that could close to double by 2023. Keep in mind multiples have increased since 2008/2010. Even if I assume no growth moving forward, I see a 50% upside potential in 12 months on debt repayment alone. I strongly believe that given its growth profile, the industry it operates in, and the value of its technology (takeout target), the stock could easily trade at 10x EBITDA and that would make it close to an $8 stock if applied on 2023’s numbers.

Risks

As mentioned previously, the stock is extremely illiquid.

Customer concentration (normal in the small-cap world): Customer A and Customer B account for 19% and 11% of revenue, respectively.

Lack of transparency; No earnings calls, little IR initiatives. I believe this can change if they sit down with one or two long-term institutional investors.

ETS LTD owns 43% of the shares outstanding and seems to be affiliated with ADS securities, a Saudi-based brokerage firm (Karim Sehnaoui, one of the board members of TRCK, is the CIO of ADS and a director at ETS). I am unsure of ETS's long-term strategy with the company, but Mr. Sehnaoui’s bio seems to imply they are long-term holders. They acquired the shares following Sapinda’s (previous owner of the shares, Lars Windhorst) event of default in 2017.

Finally, I want to thank everyone who took the time to read this article. If you like the content I publish, please take a moment of your time to subscribe and follow me on Twitter @InflexioSearch

Additional Links:

https://www.pewtrusts.org/-/media/assets/2016/10/use_of_electronic_offender_tracking_devices_expands_sharply.pdf

https://news.bloomberglaw.com/white-collar-and-criminal-law/covid-19-created-a-bigger-market-for-electronic-ankle-monitors

Disclaimer: I am long TRCK. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Thanks for the informative write-up, I enjoyed reading it.

Couple of questions:

What leads you to the conclusion to say that TRCK's products are top-tier?

What do you mean by them financing monitoring centers? I understand they provide hard- and software only.

I don't understand the valuation - if this is a SaaS business, I would guess that incremental margins will be way higher. Why is the industry so strongly penalized with lower multiples? TAM? Client concentration?