Update on PlayAGS (AGS) & Jakks Pacific (JAKK)

I summarize recent quarterly results and my positioning for Jakks Pacific & PlayAGS.

I want to start by thanking all of those who took the time to read and subscribe to my substack over the past month. I am still shocked by the momentum the blog has gained. I have a few ideas that I am researching and hope to share one of them soon. Nevertheless, only my highest conviction ideas will be posted. I seek quality and not quantity. I am sure you feel the same way. I will also strive to provide value-added content regularly without spamming your inbox.

JAKK & AGS have recently released their Q2 2021 results and I think it is fitting to revisit my positioning and some of my assumptions. I have also provided updates for each stock on my Twitter account. I usually provide quick updates when material events are announced, so make sure to follow me for timely updates!

PlayAGS (AGS) Update

For those who have not read my initial AGS pitch, here is the link.

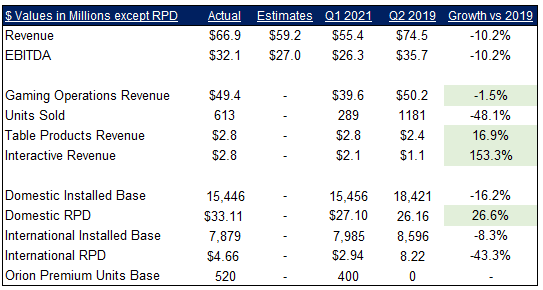

The company reported its Q2 2021 results aftermarket on August 5th. Overall, it was solid. The thesis is playing out.

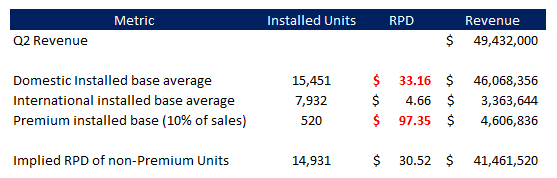

Premium Units Carve-Out

In the earnings call, the management team mentioned that their premium units already represent around 10% of gaming operations revenue. This comment helped me extrapolate revenue/day/units (RPD) contribution from premium units.

Note that RPD does not reconcile due to the installed base movement throughout the quarter. In addition, the company has a small number of legacy premium ‘Big Red’ units which I did not include in the analysis (the #s are not disclosed). Regardless, over $90 RPD for the premium units is phenomenal. The management reiterated that it is likely elevated right now and might come down. However, they are confident in keeping domestic RPD higher than pre-COVID levels.

Other Key Points

The second half of the year will likely surpass the first half. The replacement cycle is picking up and management sees improving equipment sales for the second half.

RMG grew 62% QoQ and over 110% YoY. The momentum is carrying into July. The company is launching various new products for their Table Products and will continue to focus on growth.

The “bad” stuff

Management believes that international RPD might take years to return to pre-covid levels. They are likely being conservative in their assumptions. I agree that international markets will be slower to recover than the United States. But, the chances of returning to a normalized RPD by mid-2022 seem plausible. Vaccinations are accelerating in other parts of the world. It is only a matter of time before borders re-open, despite the delta variant.

They also expect EBITDA margins in 2021 to be at the lower end of their 45-47% guidance as they reinvest for growth. Capex will also be elevated but still below 2019 levels. This is a good thing. The thesis revolves around their ability to take market share, which can only be done through investments.

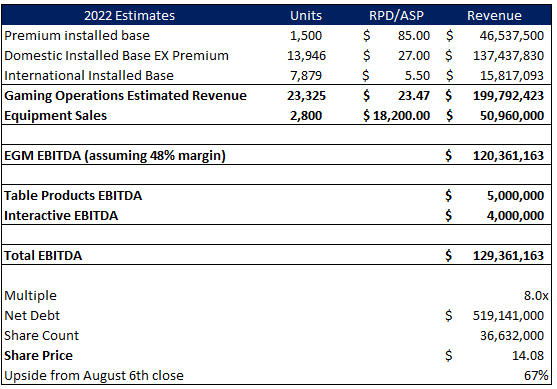

New Valuation

Let’s assume a scenario where the installed base remains constant through 2022, but premium units grow from 520 to 1500.

This gets me to a stock price worth $14.08 or a 67% upside. Again, my estimates are conservative as management mentioned installed base would grow sequentially. In addition, EBITDA for Table Products & Interactive is lower than the current run-rate. I still believe PlayAGS’ stock to be undervalued. I am a holder of the stock at the current price.

What did you think of the quarter? anything I did not mention that you think is worth discussing?

Jakks Pacific (JAKK)

For those who have not read my initial JAKK pitch, here is the link.

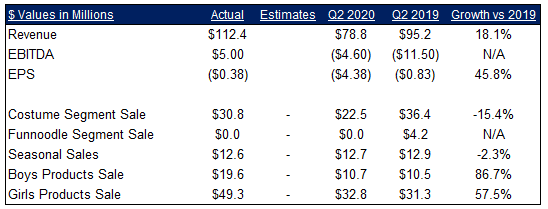

JAKK’s results were outstanding, much better than what I had hoped for.

Key Points

$2.9M outstanding on the convertible debt. Benefit Street Partners now own 1.356M shares. Interestingly, they also own ~4% of AGS. Great minds think alike...hopefully!

LTM EBITDA now stands at $49.1M. We have yet to see Q3, which is their best quarter. Recall that Halloween last year was basically canceled.

Supply chain constraints will likely impact the second half of the year, but the tone surrounding their ability to navigate these challenges was positive.

The CFO believes they can still get more gross margin leverage and sees it creeping to the low 30s. As a reminder, the last time gross margins reached 30% was in 2016.

Sentiment on the Name

I have spoken to a few analysts in other value shops. It does seem like they are warming up to the story. Bloomberg shows that various institutions are now accumulating shares.

The sell-side has yet to warm up to the name. Funny enough, BMO & Jefferies continue to rate the stock as a “hold” and their target price lags the stock’s current price. Talk about being biased.

Both outline phenomenal execution from the current management team, yet refuse to upgrade the stock. BMO did not even ask questions on the last earnings call. Will they upgrade when the stock reaches a top? That gets me thinking: When is the right time to sell a stock like JAKK?

What Exactly is the right Valuation for JAKK? When is it time to sell?

JAKK is a difficult one. Its checkered history and unattractive business model make it difficult to justify it as a long-term holding. I am constantly asking myself “Ok, when is the management going to blow up the firm again?” That is why I have categorized this pitch as a special situation name.

I do not think JAKK’s multiple will re-rate to 8-9x EBITDA anytime soon. This type of multiple expansion could take years. The same way it took years for it to compress. The multiple will slowly creep up as they continue executing. Nevertheless, I think credit has to be given where it’s due. The business has transformed over the last two years and the new CFO is showing his worth. Anywhere between 5-6x EBITDA seems reasonable to me.

I will include the convertible debt as part of the total debt and assume full dilution for simplicity's sake. I do not assume PPP forgiveness. Preferred shares are included in the net debt calculation.

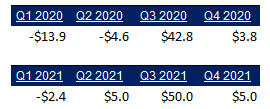

Here are my rough assumptions for EBITDA in 2021:

Remember that in Q3 2020, sales were down 13.5%. Halloween revenue was down 27.5%. The company could easily beat my Q3 & Q4 numbers. Regardless, using a 6x multiple on my current estimates gets me to a share price worth $23.38. With some margin of safety, the stock starts getting fairly valued at around $18-20. Obviously, I will re-assess if they blow my estimates out of the water.

JAKK is currently my largest position and I remain bullish in the short term.

Disclaimer: I am long AGS & JAKK. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.